Table of Contents

- SMCI Stock Forecast: What's next? | SMCI stock price prediction! - YouTube

- 👀 SMCI Stock (Super Micro Computer) SMCI STOCK PREDICTIONS! SMCI STOCK ...

- SMCI stock surges 10% as JPMorgan starts at buy By Investing.com

- SMCI Stock Alert: Super Micro Computer Surges Higher in AI Frenzy ...

- Why I covered my SMCI stock short - YouTube

- SMCI Stock Analysis | SMCI Stock Price Prediction - YouTube

- SMCI Stock (Super Micro Computer stock) SMCI stock PREDICTION SMCI ...

- SMCI Stock Soars As Supermicro Hikes Outlook | Investor's Business Daily

- SMCI stock is nearly PERFECT to short - YouTube

- Here’s Why Supermicro Stock (SMCI) Jumped Over 12% - TipRanks.com

Current SMCI Stock Price

Recent Performance

Factors Influencing SMCI Stock Price

Several factors contribute to the fluctuations in SMCI stock price, including: Financial Performance: The company's revenue growth, profit margins, and earnings per share (EPS) are closely watched by investors, influencing the stock price. Industry Trends: The demand for server and storage solutions, as well as the overall health of the technology sector, impacts SMCI stock price. Competitor Activity: The actions of competitors, such as new product releases or strategic partnerships, can influence investor sentiment and SMCI stock price. Economic Conditions: Global economic trends, trade policies, and interest rates can impact the overall market and, in turn, affect SMCI stock price.

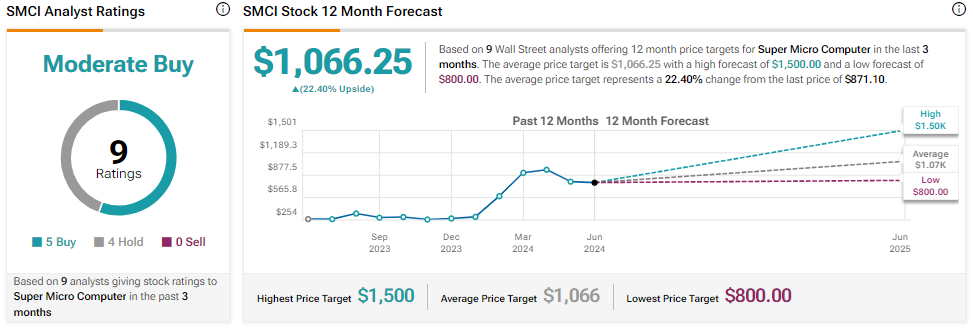

Investor Sentiment and Analyst Estimates

Analysts' estimates and investor sentiment play a significant role in shaping SMCI stock price. Currently, the consensus rating among analysts is "Buy", indicating a positive outlook for the company's future performance. The average price target for SMCI stock is around $55, suggesting potential for further growth. In conclusion, the SMCI stock price is influenced by a combination of factors, including financial performance, industry trends, competitor activity, and economic conditions. With its strong recent performance and positive analyst estimates, SMCI stock is an attractive option for investors looking to capitalize on the growing demand for server and storage solutions. As with any investment, it is essential to conduct thorough research and consider individual financial goals and risk tolerance before making any investment decisions.Stay up-to-date with the latest SMCI stock price and news by following reputable financial news sources and tracking the company's performance on financial platforms.

Note: This article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making any investment decisions. Keyword: SMCI Stock Price, Super Micro Computer Inc., NASDAQ, server and storage solutions, stock performance, financial performance, industry trends, competitor activity, economic conditions, investor sentiment, analyst estimates.